- Big pharmaceutical companies like Bristol Myers Squibb, Merck and Johnson & Johnson face so-called patent cliffs that will put tens of billions of dollars in sales at risk between now and 2030.

- That refers to when patents expire for one or more leading branded products for a company, which opens up the door for competitors to sell copycats of those drugs, often at a lower price.

- Some companies appear to be well-prepared to offset some of the losses from upcoming patent expirations.

Big pharmaceutical companies such as Bristol Myers Squibb, Merck and Johnson & Johnson face a looming threat that will put tens of billions of dollars in sales at risk between now and 2030, as blockbuster drugs will tumble off a so-called patent cliff.

That refers to when a company's patents for one or more leading branded products expire, which opens the door for competitors to sell copycats of those drugs, often at a lower price. That typically causes revenue to fall for drugmakers and costs to drop for patients, who can access more affordable options.

Certain drugmakers appear well prepared to offset some losses from upcoming patent cliffs, as they build their drug pipelines and ink acquisitions or partnerships with other companies, some Wall Street analysts said.

Get top local stories in DFW delivered to you every morning. Sign up for NBC DFW's News Headlines newsletter.

Patent cliffs are an unavoidable issue for pharmaceutical companies. They must replenish older top-selling drugs with new ones that they hope will not just sustain their sales, but also grow them.

The loss of exclusive rights on a drug can affect companies differently, depending on how much of their sales they get from the product or what type of treatment it is. Some drugs facing patent expirations will also be subject to the Biden administration's Medicare drug price negotiations, a policy that may further threaten the companies' revenues.

The top 20 biopharma companies have $180 billion in sales at risk from patent expirations between now and 2028, according to estimates from EY.

Money Report

"It does differ by company at this stage, and I think there are a number of products in the '25, '30 timeframe that will be major growth drivers for large biopharma companies … but all in all, there are plenty of companies that have revenue holes to plug," William Blair & Company analyst Matt Phipps told CNBC.

Some top drugs set to lose exclusivity

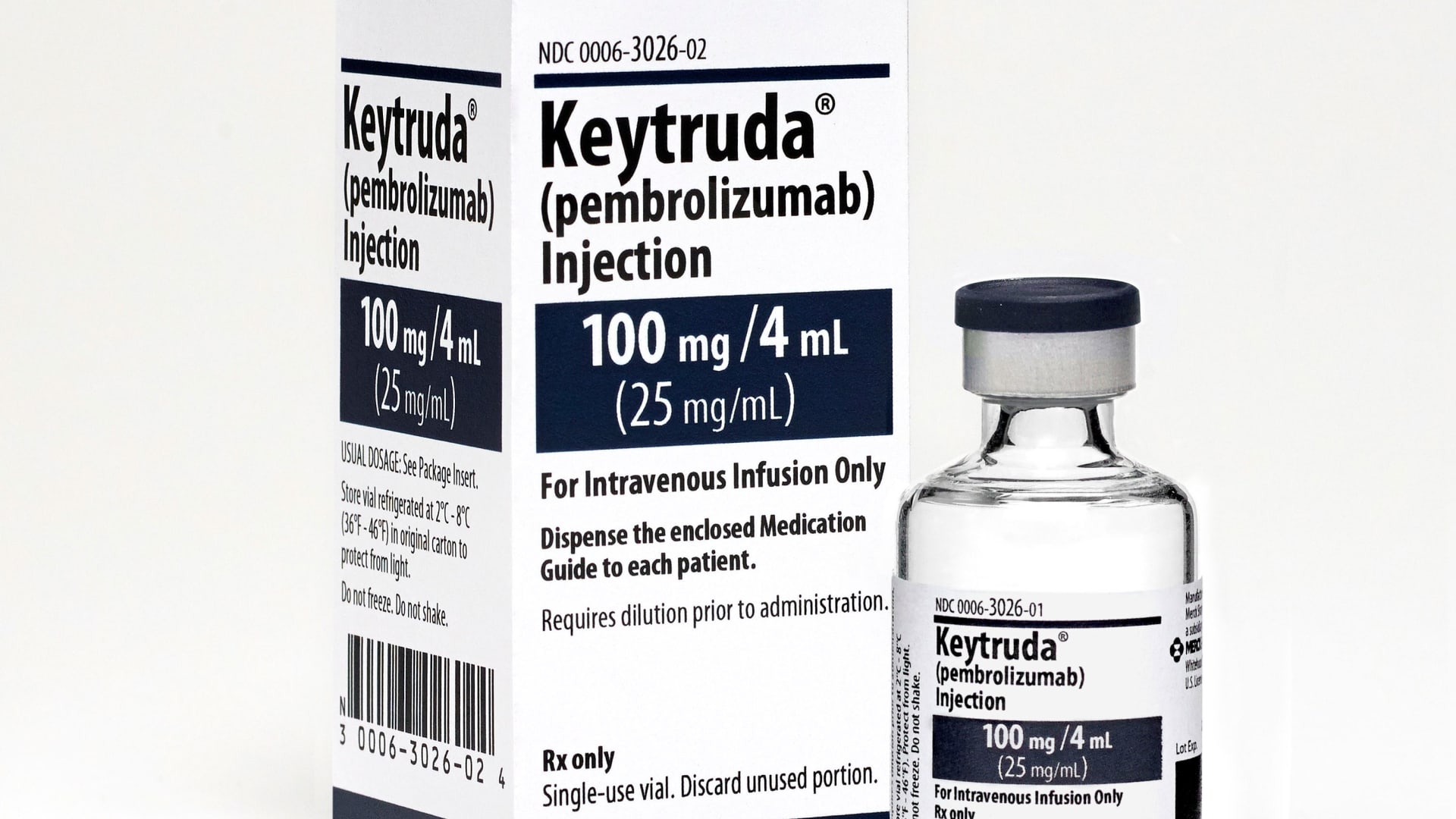

Merck's Keytruda is an immunotherapy that treats melanoma, head and neck, lung and other certain types of cancers.

- Key patent expirations: 2028

- 2022 sales: $20.94 billion

- Percentage of company's total 2022 sales: Roughly 36%

- Estimated future revenue: $14.9 billion in 2030, according to Guggenheim estimates.

Bristol Myers Squibb's Eliquis is a blood thinner used to prevent clotting, to reduce the risk of stroke.

- Key patent expirations: 2026 to 2028

- 2022 sales: $11.79 billion

- Percentage of company's total 2022 sales: Around 25%

- Estimated future revenue: $478 million in 2032, according to Leerink Partners estimates.

Bristol Myers Squibb's Opdivo is an immunotherapy used to treat cancers, including melanoma and lung cancer.

- Key patent expirations: 2028

- 2022 sales: $8.25 billion

- Percentage of total 2022 sales: Almost 18%

- Estimated future revenue: $3.18 billion in 2032, according to Leerink Partners estimates.

Johnson & Johnson's Stelara is an immunosuppressive medication used to lower inflammation and treat several conditions, including plaque psoriasis and psoriatic arthritis.

- Key patent expirations: 2024 in Europe, 2025 in the U.S. (Stelara's patents began to expire in the U.S. last year, but the company struck deals with competitors to delay the launches of copycat drugs).

- 2022 sales: $10.86 billion

- Percentage of total 2022 sales: Around 12%

- Estimated future revenue: $2.63 billion in 2028, according to FactSet estimates.

The type of drug matters

Patent cliffs could differ depending on whether the product is a small-molecule drug – meaning it's made of chemicals that have low molecular weight – or a biologic, or a medicine derived from living sources such as animals or humans.

Many of the biggest drugs facing upcoming patent expirations are biologics, including Merck's Keytruda, J&J's Stelara and Bristol Myers Squibb's Opdivo. Those drugs will inevitably rake in less revenue, but it may take time before so-called biosimilars threaten their dominance.

Investors will get updates on Merck and Bristol Myers Squibb's plans for the years ahead when they report earnings on Thursday and Friday, respectively.

Phipps said biosimilars have historically "had trouble gaining market share" from their branded counterparts. That's unlike generics, which are cheaper copycats of small-molecule drugs like Bristol Myers Squibb's Eliquis.

The difference is that many biosimilars aren't identical copies of branded biologic drugs, while generics are.

That means biosimilars are not interchangeable: Pharmacists can't directly substitute a branded biologic for a biosimilar when filling a prescription. Not all patients will react to a biosimilar in the same way as they do to a biologic, which makes some physicians more wary of switching patients to them.

Biosimilars also cost much more to research and develop, and are more complex to manufacture, than generics, making biosimilar makers less willing to sell them at significant discounts to branded counterparts, Phipps noted.

One example is AbbVie's Humira, a biologic that helps treat an array of inflammatory diseases. Several biosimilars of Humira debuted on the market last year, but the drug has so far only lost 2% of its market share to those copycats, according to a report released this month by Samsung's biopharmaceutical subsidiary, Bioepis.

That's partly because the drugmaker has offered rebates on Humira to pharmacy benefit managers. Its lower price has cut revenue, but it is also helping the drug stay competitive.

"What's really impacted is not volume in the market, it's price," Piper Sandler senior analyst Christopher Raymond said. He added that Humira is a highly profitable drug, so AbbVie can set a lower price and "still maintain a very, very decent margin."

Still, AbbVie expects that Humira's revenue declined by 35% last year compared to 2022, when the drug raked in more than $21 billion.

Raymond forecasts a 33% drop in 2023 and an identical decline in 2024, to slash its revenue to about $9.5 billion.

Drugmakers prepare to offset losses

JPMorgan sees the upcoming patent cliffs in the mid-2020s as "largely manageable" as drug pipelines improve, and expects the biopharmaceutical industry's sales to be "roughly stable" through 2030, analyst Chris Schott said in a note in December.

Take Merck: Schott wrote in a January note that the company "has made substantial progress in addressing its post Keytruda" patent expiration, adding that the company's "post 2028 profile is looking increasingly attractive."

During the JPMorgan Health Care Conference earlier this month, Merck CEO Robert Davis said the company expects to have more than $20 billion in sales from oncology drugs by the mid-2030s, which is double the forecast the company provided during the same time last year.

That improved outlook now includes three antibody-drug conjugates – which target cancer cells and minimize damage to healthy ones – from the licensing agreement Merck inked with Daiichi Sankyo in October. It also includes Merck and Moderna's personalized cancer vaccine, which has yielded promising mid-stage data when combined with Keytruda to treat the most deadly form of skin cancer.

The company also hiked its revenue outlook for cardiometabolic drugs to around $15 billion by the mid-2030s, up from a previous guidance of $10 billion.

Davis noted that Merck views Keytruda's patent expiration as a "hill, not a cliff," and is focused on making "the dip as small as possible and the return to growth as fast as possible."

Meanwhile, JPMorgan's Schott said shares of Bristol Myers Squibb had a challenging 2023, as new drugs ramped up "slower than expected."

But JPMorgan expects those new products, along with the drugmaker's recent acquisitions and growing mid- to late-stage pipeline, will "ultimately position the company for growth" after upcoming patent expirations. For example, Bristol Myers Squibb acquired Karuna Therapeutics, which develops drugs for psychiatric and neurological conditions, for $14 billion in December.

Meanwhile, Schott said he believes J&J is "well positioned for healthy growth" after Stelara's patent expires. The firm believes the company's pharmaceutical business can deliver mid-single digit sales growth through 2030, he wrote in a December note.

J&J's medical devices business is also becoming a bigger share of the company's revenue, which could help the company offset the Stelara patent cliff, CFRA analyst Sel Hardy said. The business raked in roughly $30 billion of J&J's total $85 billion in 2023 sales.

In addition to internal developments, companies will likely look for opportunities to acquire more drugs, particularly those in late-stage development that are close to entering the market, said Arda Ural, EY's Americas industry markets leader in health sciences and wellness.

The biotech and pharmaceutical industry is also starting the year off with about $1.4 trillion on hand to make deals, he added.

Drugmakers buy more time

To avoid losing revenue, pharmaceutical companies are also moving to delay competition or extend patent protections on drugs.

Merck is testing a new, more convenient version of Keytruda that can be injected under the skin rather than through intravenous infusion. If that new form is approved, it may land the company a separate patent and extend Keytruda's market exclusivity by several years.

Bristol Myers Squibb is also testing a new form of Opdivo, which is currently administered into a patient's veins. A version that's injected under the skin showed promising results in a late-stage trial in October, and could also lead to extended market exclusivity.

J&J's strategy with Stelara is a bit different.

In 2022, J&J sued Amgen over its plan to market a biosimilar for Stelara, saying it would infringe two patents for the drug. J&J confidentially settled that lawsuit in May, but will allow Amgen to sell its biosimilar of Stelara no later than 2025.

A month later, J&J reached similar settlements with Alvotech and Teva Pharmaceuticals, which are also planning to launch a biosimilar of Stelara.

"Pharma is doing what they can to make sure that they squeezed that the most they can out of these drugs before they open up widely," Mike Perrone, Baird's biotech specialist, told CNBC. But he noted that "while you can tack on some years and extend revenues, there's only so much time you can add."

Medicare drug price negotiations are a factor

Medicare drug price negotiations under the Inflation Reduction Act are an additional threat to companies, but how the policy affects revenues could differ depending on when a drug loses exclusivity.

Medicare is beginning price talks for the first round of 10 prescription medications this year. The talks include Stelara and Eliquis, along with a few other treatments facing patent expirations.

By the fall, the federal government will publish the agreed-upon prices for those medications, which will go into effect in 2026.

It's too early to know how much Medicare will be able to negotiate down prices.

But some experts said lower prices in 2026 may have less of an effect on drugs already expected to see revenue decline as patents expire around the same time. For example, Stelara will lose exclusivity in the U.S. in 2025.

It's a slightly different story for drugs that will face generic competition after 2026. Perrone said a lower negotiated price on a drug will result in companies losing revenue even before the patents expire.

Still, he said the bigger threat to revenue for drugs – regardless of when they lose exclusivity – is competitors entering the market, not a new negotiated price with Medicare.