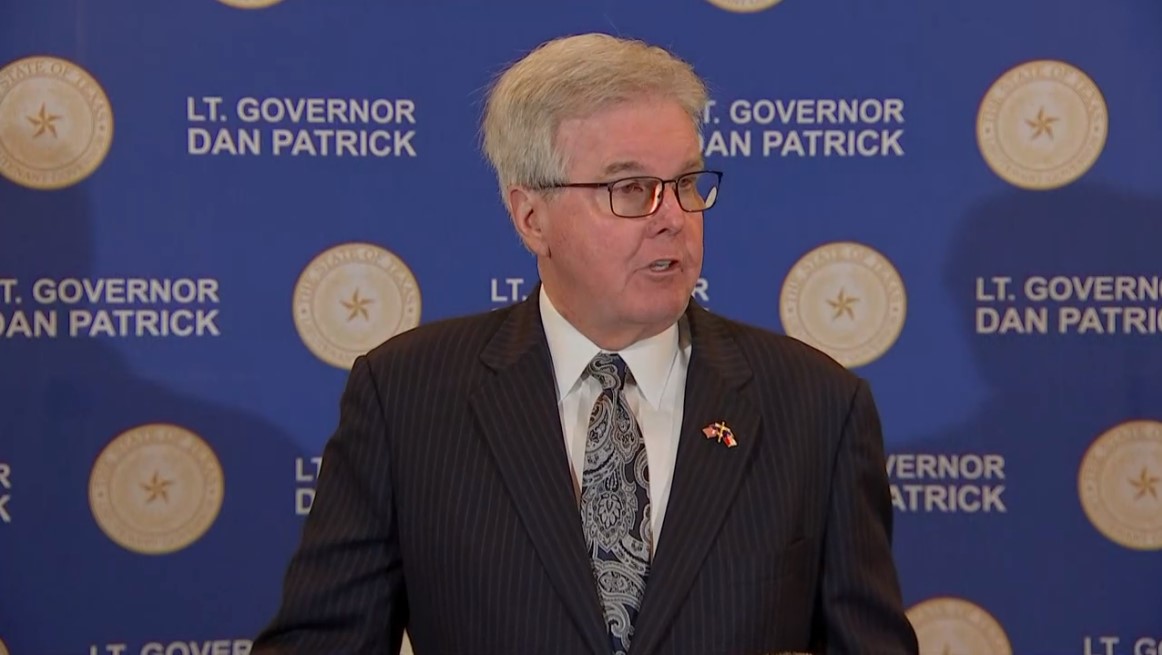

Texas Lt. Gov. Dan Patrick (R) announced a new property tax bill Tuesday afternoon that includes more tax cuts for businesses.

Patrick said all 31 state Senators approved the new $18 billion plan Tuesday, making it the largest property tax cut in state history.

Patrick said Senators added $400 million to the previous $17.6 billion earmarked for property tax relief. The lieutenant governor said the bill gives homeowners approximately a 41% cut in their school taxes and gives businesses the biggest cut they've ever had. The bill also preserves the homestead exemption and creates new paths to save small businesses money.

Get top local stories in DFW delivered to you every morning. Sign up for NBC DFW's News Headlines newsletter.

State Sen. Paul Bettencourt (R-Houston, District 7), who proposed the bill, said the Senate's plan still uses compression and the homestead exemption to save homeowners money.

"The components are simply this, there is a tremendous amount of what’s called tax rate compression in here. But there’s also an eye-popping $5.3 billion for homestead exemptions, which is critical," Bettencourt said. "That means that the homesteads, homeowners – all 5.17 million of them – will be getting $1,270 in the first year savings. If you happen to be over 65, those savings are really $1,450.

Bettencourt said the final component is again lowering the rollback rate for cities, counties and school districts from 2.5% to 1.7%.

At a press conference Tuesday, all 31 Texas state senators were present.

"Yes, there have been issues in the past that we have not agreed upon. This is one we agree upon for all of our constituents," said Sen. Royce West (D-Dallas, District 23).

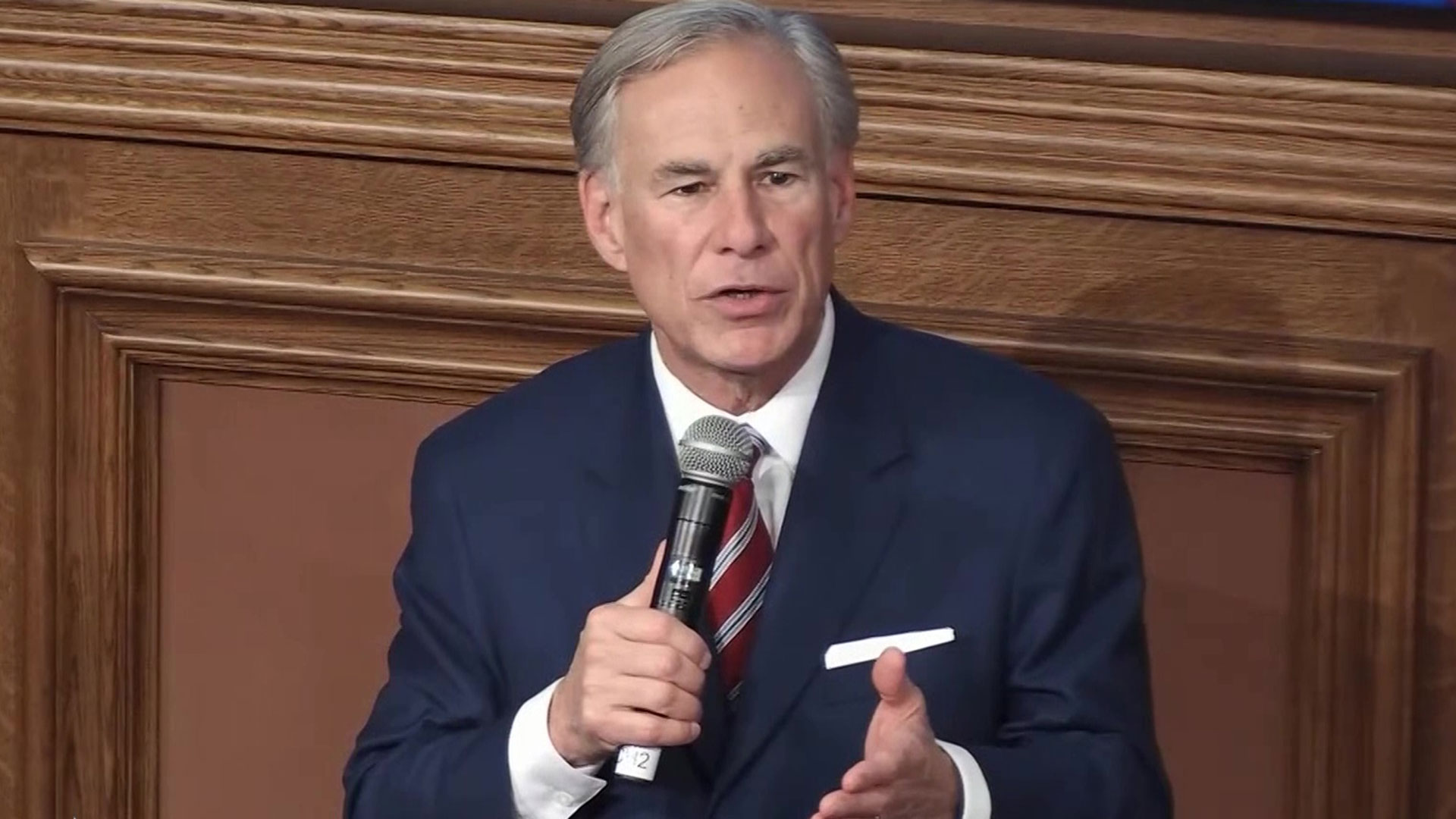

The governor's office, meanwhile, said Abbott continues to encourage the two chambers to work together on a solution that'll end up on his desk.

"The governor has been clear that his goal is to put Texans on a pathway to eliminate their school M&O property taxes, and the best way to do that is to devote all property tax relief to cutting property tax rates," Abbott's office said in a statement Tuesday. "The governor has also been clear that the only way a property tax bill gets to his desk is for the Texas House and Texas Senate to agree to a bill and get it to the governor's desk, and he encourages the two chambers to work towards a solution."

Patrick, the leader of the Texas Senate, has been held up in a stalemate with Republican Dade Phelan, the Speaker of the Texas House, over the best way to provide millions of Texans with property tax relief.

Gov. Greg Abbott (R) has tasked state legislators with approving a $17.6 billion plan to reduce the property tax burden. Both the House and Senate have put forth plans, though they have yet to agree on a path forward.

The Senate previously wanted to use compression, which would reduce the school district's maximum compressed tax rate, along with an increase of the homestead exemption from $40,000 to $100,000. The House's plan uses only compression and spreads the relief across both residential and commercial property owners.

The House gaveled out of the special session last month and has resisted calls from the Senate to return, so the future of the Senate's new bill is uncertain.

Abbott, who said he'd call "special session after special session until a solution is reached," gave the chambers an ultimatum last week threatening to veto bills awaiting his signature. While the governor did sign the state budget on Sunday, he did follow through on his threat to veto legislation.

TEXAS HOUSE CREATES COMMITTEE TO STUDY PROPERTY TAX RELIEF

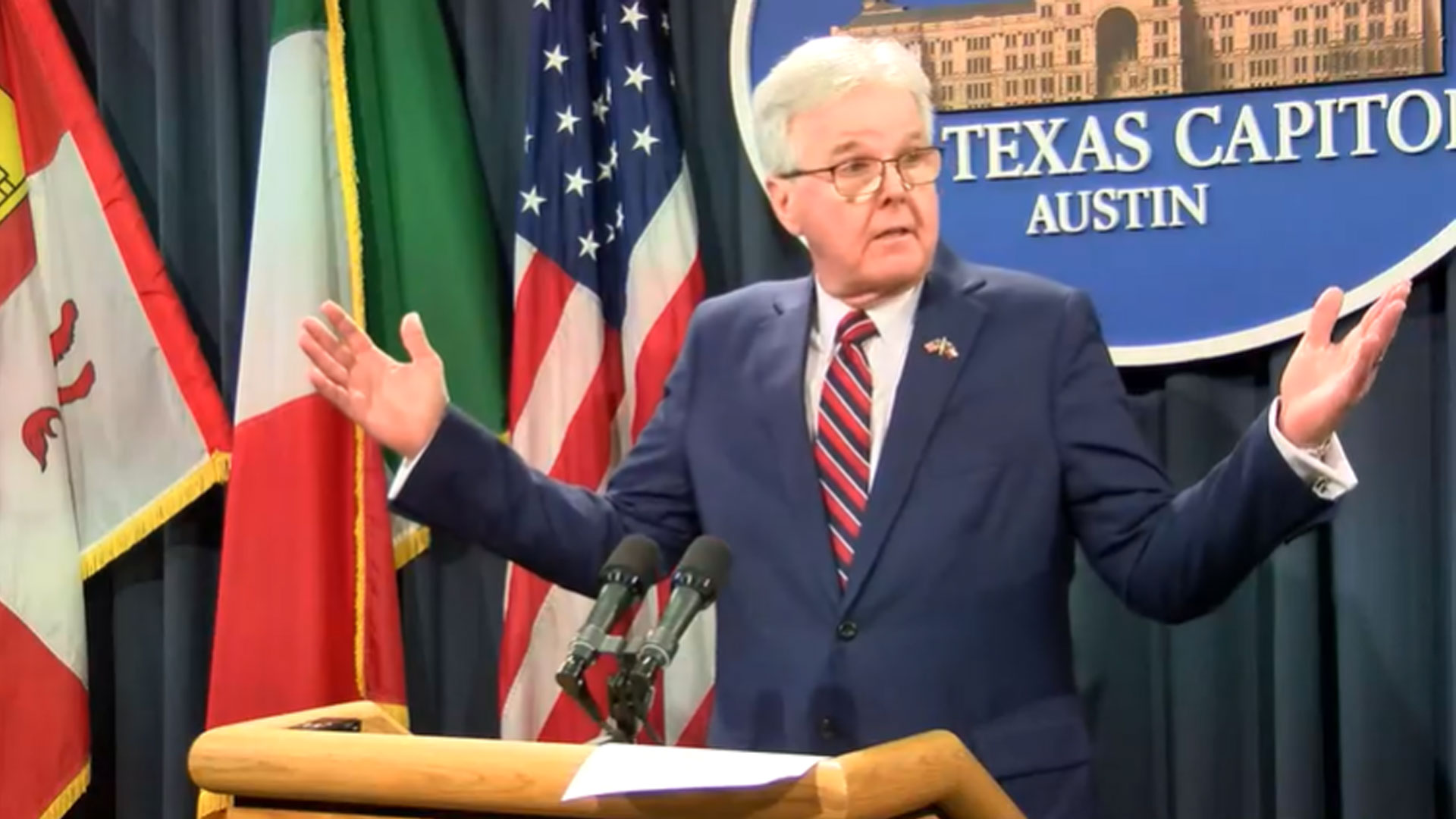

On Tuesday, ahead of Patrick's news conference, Phelan's office announced the creation of the House Select Study Committee on Sustainable Property Tax Relief.

The 16-member committee is made up of 13 House members and three public members. The group will be tasked with considering issues that broadly affect property taxes and make recommendations for long-term, sustainable property tax relief for Texas property owners.

“The burden of rising property taxes weighs heavily on our state’s property owners, and it is imperative that we look beyond the current special session to identify long-term, sustainable solutions to this evergreen problem,” said Phelan.

Phelan's office said the committee will evaluate the dynamic effects of compression, limits on taxable value, and homestead exemption increases to maximize savings. The committee will also study the viability and sustainability of eliminating the school maintenance and operations taxes by 2035; examine the historical rates of appraisal increases and recommend methods to reduce the tax burden of those increases on real property; and examine the long-term value of homestead exemptions in conjunction with the impact of appraisal increases.

The committee is made up of Rep. Morgan Meyer, Chair, Rep. Shawn Thierry, Vice-Chair, Rep. Steve Allison, Rep. Dustin Burrows, Rep. Mano DeAyala, Rep. Donna Howard, Rep. Janie Lopez, Rep. Candy Noble, Rep. Richard Pena Raymond, Rep. Hugh Shine, Rep. Ellen Troxclair, Rep. Chris Turner, Rep. Armando Walle; Cheryl Johnson, public member; Brad Livingston, public member; Don “Skeeter” Miller, public member.