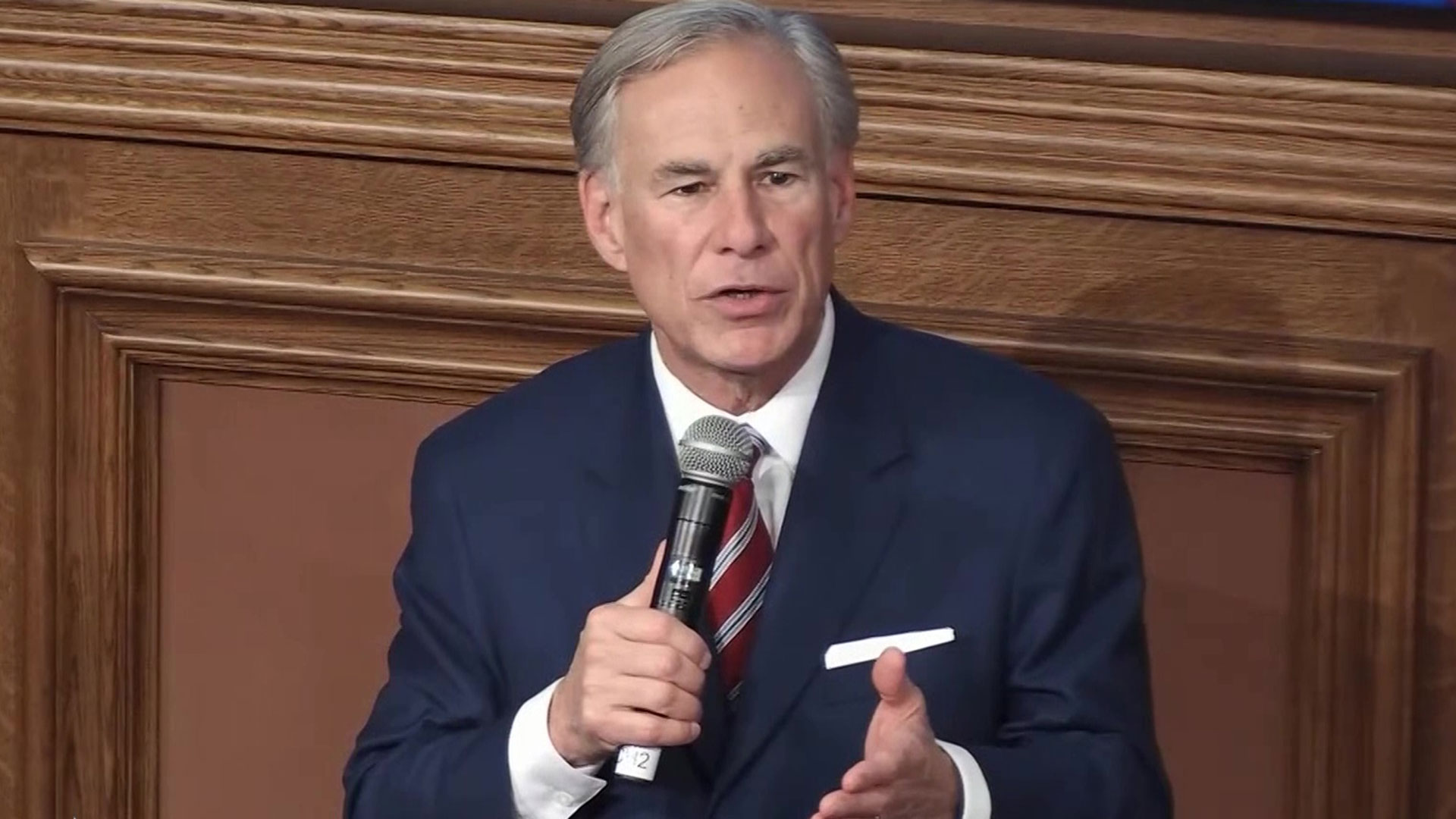

The ongoing battle of property taxes in Texas intensified over the weekend as Gov. Greg Abbott (R) followed through on a threat to veto bills passed during the 88th legislative session.

Leading up to his deadline Sunday, Abbott vetoed 77 bills passed by the Texas House and Senate during the last session. The governor did sign the state's two-year $321 billion budget.

The common theme of many of the more recent vetoes: the bills can wait until after lawmakers figure out property taxes, the subject of the ongoing special session of the legislature.

The House and Senate have been at odds over how to deliver the best property tax relief since the session began on May 29.

Get top local stories in DFW delivered to you every morning. >Sign up for NBC DFW's News Headlines newsletter.

The House plan – supported by Gov. Abbott – aims to use tax compression to send most of that money to school districts so they can lower taxes on all property owners of homes and businesses alike. It does not include any additional homestead exemption and spreads the $17.6 billion of relief across both residential and commercial property owners.

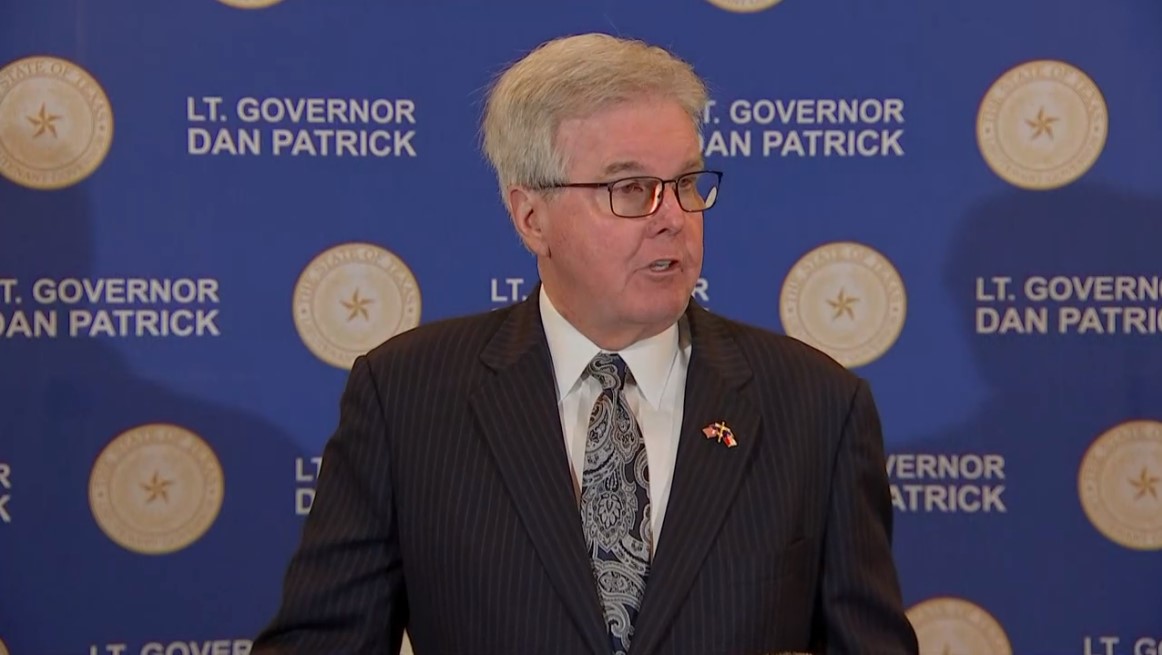

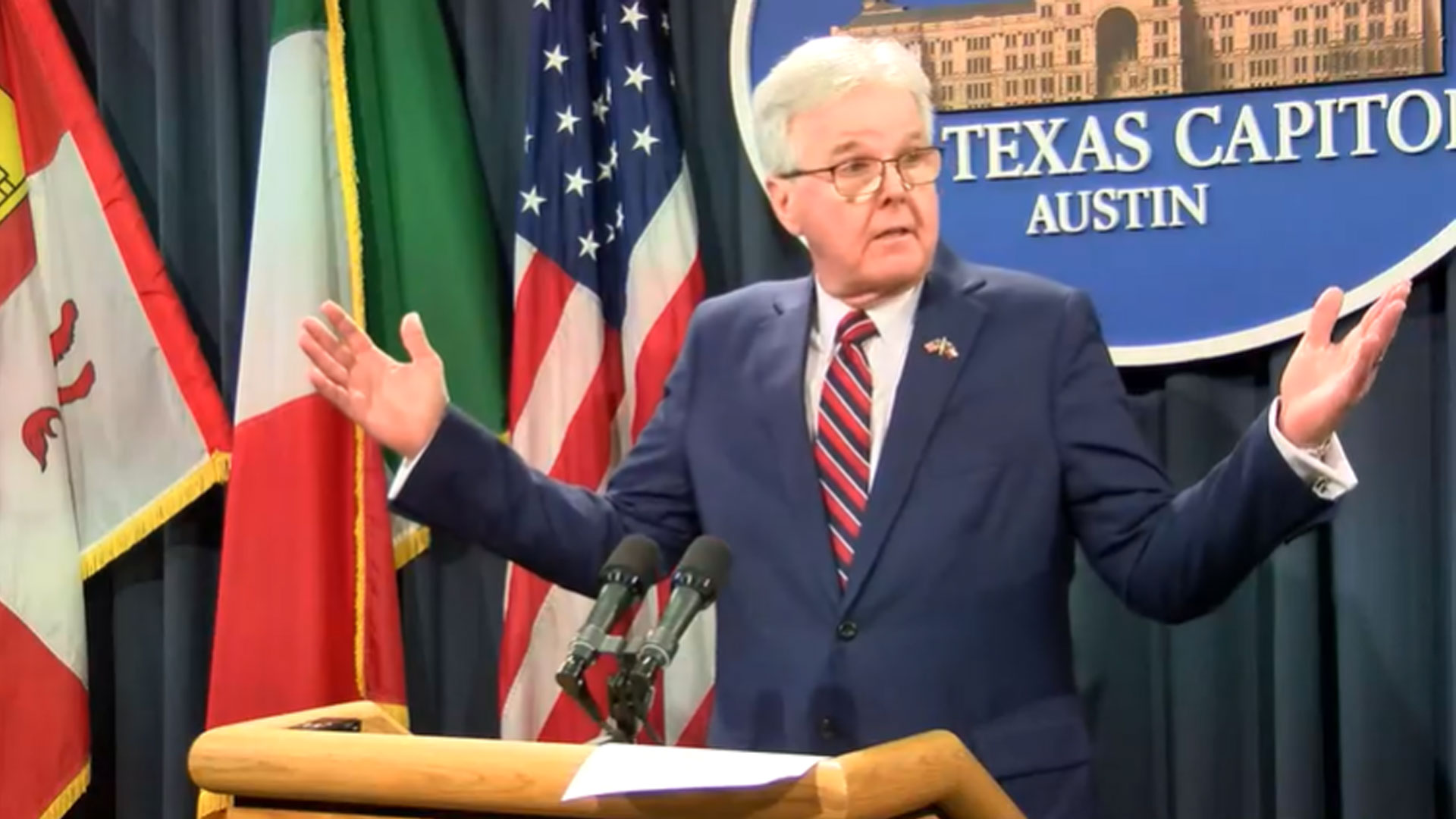

The Patrick-supported Senate plan also uses compression but sends less money to school districts and focuses instead on giving homeowners bigger breaks and bumping up the homestead exemption from $40,000 to $100,000.

Patrick, who leads the Texas Senate, has criticized the House for gaveling out of the session last month after putting up a property tax bill that only includes compression and not the previously passed increased homestead exemption of $100,000.

Abbott, meanwhile, has said he'd call "special session after special session until a solution is reached."