When will Texans see a break in property taxes? The holdup in Austin continues with the state's top Republican leaders at odds over two plans.

Texas Lt. Gov. Dan Patrick (R) called on the Texas House to return to Austin Tuesday and continue working with the Senate on special session legislation.

Patrick, who leads the Texas Senate, criticized the House for gaveling out of the session last week after putting up a property tax bill that only includes compression and not the previously passed increased homestead exemption. He added a chamber isn't allowed to sine die without approval from the other chamber and that the House left the session without Senate approval.

"The Senate continues to work and the House stays home," Patrick said.

Get top local stories in DFW delivered to you every morning. >Sign up for NBC DFW's News Headlines newsletter.

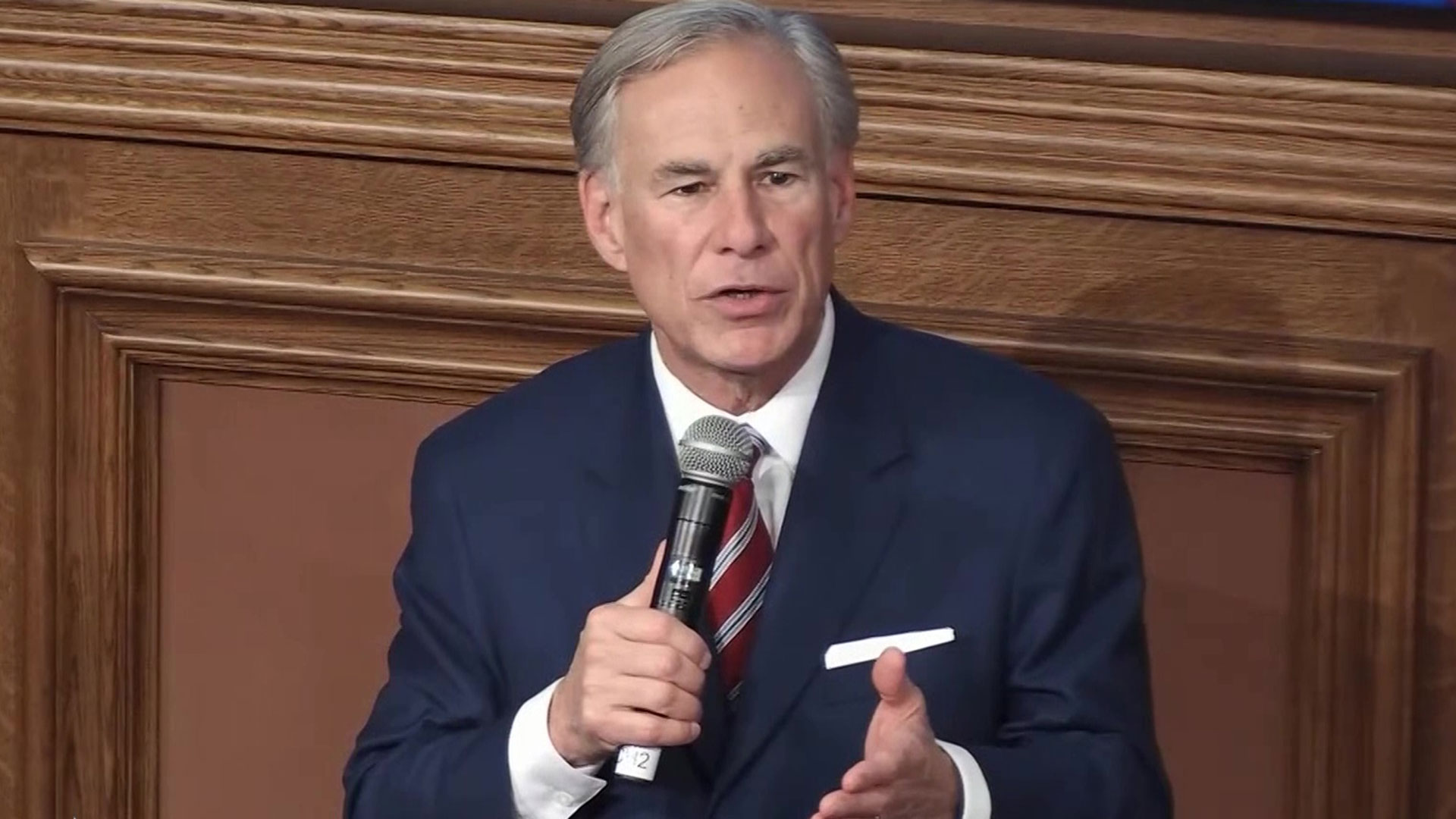

Patrick has been embroiled in a Twitter spat with Gov. Greg Abbott (R) since last week after the governor said the House had the best plan for lowering property taxes.

The Senate plan to lower property taxes for homeowners uses both compression of the school M&O tax and also includes increasing the homestead exemption to $100,000. The House plan does not include any additional homestead exemption and spreads the $17.6 billion of relief across both residential and commercial property owners.

"Our plan is the fairest to every homeowner," Patrick said, adding his plan would save homeowners more money and the homestead exemption was previously passed by the House by a vote of 147-0.

Abbott responded to Patrick's remarks at a bill signing Tuesday afternoon saying, "I'll call special session after special session until a solution is reached."

Abbott did not directly respond to questions regarding what he would do if a bill including homestead exemption landed on his desk.

In a statement to NBC 5, a spokesperson for House Speaker Dade Phelan released the following:

"The Texas Senate is the only chamber that has not passed property tax reform and border security legislation in a way that is germane to Governor Abbott’s special session call. The House has passed the largest property tax cut in state history three times this year. In the special session, the House came to work, passed its bills with bipartisan support, and adjourned -- the Senate is keeping Texans waiting. We encourage the Senate to follow the House’s lead so that Texans can have the property tax relief and the secure border they deserve.”

PROPERTY TAX LEGISLATION

NBC 5 asked SMU Cox School of Business economics professor Mike Davis for his insight.

"The Senate plan would give homeowners slightly more of a tax break," Davis said. "But remember there would be other groups – businesses, landlords and tenants who would probably get slightly less of an immediate break."

Davis said arguments could be made for both plans and predicting what's best long term is challenging.

“These taxes are like cockroaches. You put them down in one place and they go hide everywhere,” Davis said. “A tax break on homes can sometimes actually translate itself into higher home prices. When you put taxes on businesses, businesses pass those taxes on to their customers. So the point is taxes don’t stay in one place.”

During Tuesday's briefing, Patrick said the governor's plan to eliminate property taxes by funding the state government solely on sales taxes is unsustainable because of the potential for lower tax receipts should the state economy take a downturn.

"It's a long and pot-holed-filled road between now and having no property taxes eliminated here in the state of Texas," Davis said. "There's a lot to be said of that as an ideal, but given how our taxes in this state work it's a long way to get there."