There has been a lot of chatter recently about the possibility of a recession.

Yet what exactly does that mean — and what would a potential downturn look like?

A recession is defined as "a significant decline in economic activity that is spread across the economy and that lasts more than a few months," according to the National Bureau of Economic Research.

More from Invest in You:

Suze Orman: Every person should have series I bonds

Strategies to pay off credit card debt as interest rates rise

What the Fed's rate hike means for you

Get top local stories in DFW delivered to you every morning. Sign up for NBC DFW's News Headlines newsletter.

It's also ultimately inevitable during the course of the normal economic cycle, said Mark Hamrick, senior economic analyst at Bankrate.

"It should not be shocking that they occur," he said. "It is usually the timing, the cause and the depth and duration of them that catch people by surprise."

The risk of a recession

Money Report

Economists are watching the economy closely and many are boosting their odds of a recession occurring in the near term. Citigroup, assessing global economic growth over the next 18 months, sees a 50% probability of a global recession happening, while Goldman Sachs has put the odds of a recession for the U.S. in the next year at 30%.

However, not everyone is convinced a recession will happen.

UBS, for example, has a base case forecast of "no recession." Mark Zandi, chief economist at Moody's Analytics, also thinks as things stand now, a recession is unlikely.

"The economy is slowing and it will be uncomfortable over the next 12 to 24 months, but I think we will make our way through it without a recession," he said.

Of course, something could happen to change that projection.

"We are very vulnerable to anything else that could go wrong because things are so fragile," Zandi explained.

'The economy comes to a standstill'

Still, Zandi's current prediction still means some economic pain ahead. "The economy comes to a standstill, meaning months where we are getting little job growth or negative job growth," he said.

Unemployment would start to notch higher, perhaps hitting 4% or 4.5% and inflation, while moderating, will still be high, he said.

He doesn't see stock prices going anywhere and housing values remaining, at best, flat or even declining in some markets.

"For the average American, it is not just going to feel great," he said.

What happens during different types of recessions

The duration and depth of recessions are characterized by shapes.

For instance, a V-shaped recovery is quick, with a sharp decline to a bottom followed by a dramatic rise. In a U-shaped recovery, on the other hand, the economy spends longer at the bottom and then gradually rebounds.

A W-recovery is when the economy passes through a recession and into recovery and then immediately enters another recession, and K-shaped means some parts of the economy recover more quickly than others.

What a 'typical' recession looks like

A post-World War II typical recession lasts about six to 12 months, although some were longer and one was shorter, Zandi said.

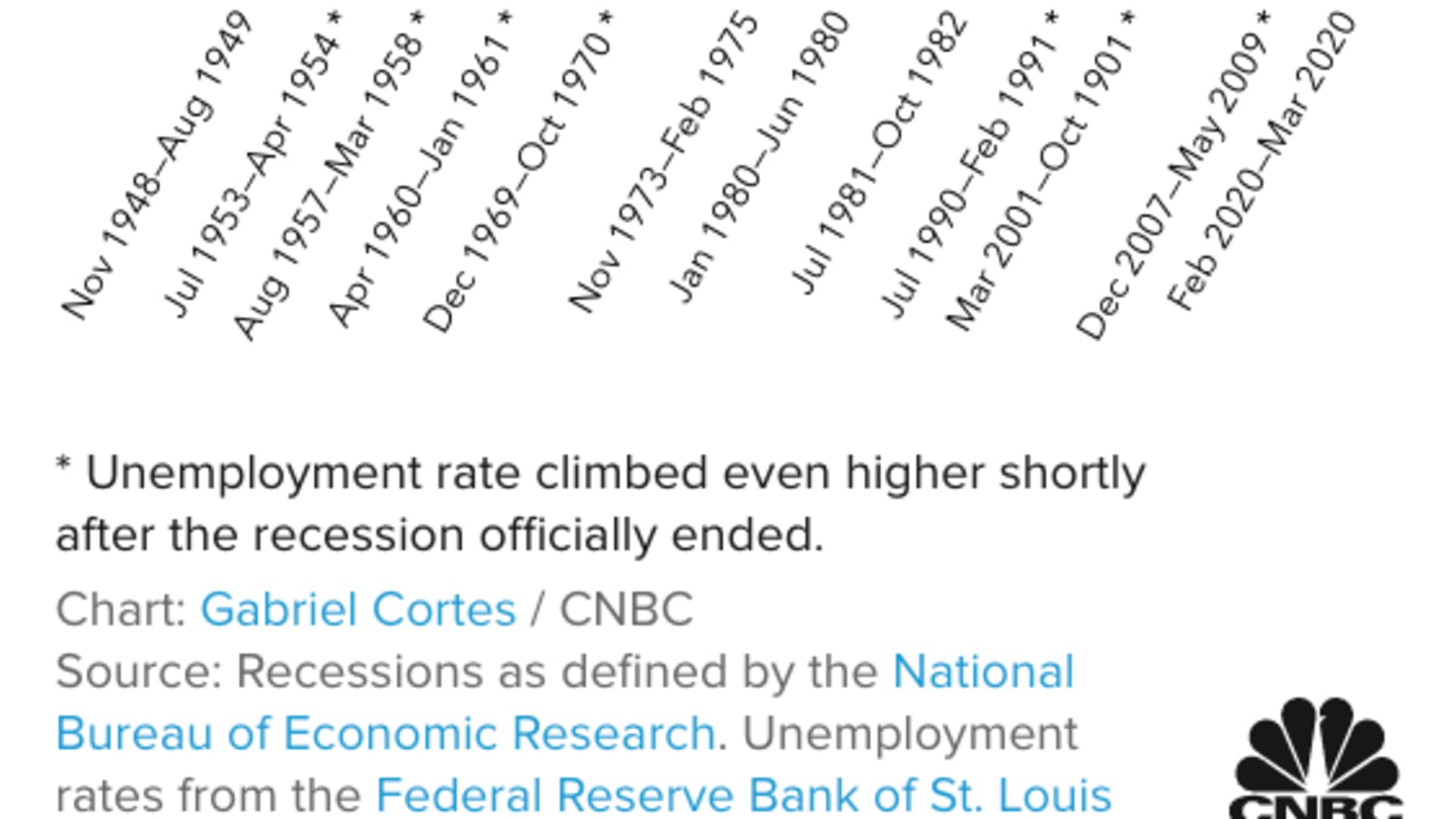

The most recent recession occurred in 2020 and was brief — only two months long. The longest recession occurring after 1948, the Great Recession, spanned 18 months, beginning December 2007 and ending June 2009.

In a garden variety recession, the economy typically loses 3 million to 4 million jobs, and unemployment can get as high as 6%, Zandi said. The stock market may fall another 5% to 10% and national house prices decline about 5% to 10%, he said.

That doesn't necessarily mean that's what will occur if the economy does fall into recession. Right now, the fundamentals of the economy are good, Zandi said.

"There is a good chance [if] we do suffer a recession, [that] it will be less severe than a typical one," he predicted.

'Prepare for the possibility' of a recession

Whether a recession happens or not, you should be ready just in case.

"I counsel people to prepare for the possibility, to pay down debt, to save money, to consider deferring large purchases," said Hamrick.

He anticipates that Bankrate's Second-Quarter Economic Indicator survey will put chances of a recession in the next 12-18 months higher than the 1-in-3 odds in the first-quarter survey.

Still, that doesn't mean the worst-case scenario.

"If there is a downturn here, I think that there is a possibility that it could be relatively short and shallow," Hamrick said. "It need not be ruinous."

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox. For the Spanish version Dinero 101, click here.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.