- With $785 million at stake, this is the fourth-largest jackpot in Mega Millions history.

- Nearly all winners opt for the immediate lump sum, which is "a big mistake," one expert said.

- There are some significant advantages to spreading out the windfall.

This could be a very good year for one lucky winner of the fourth-largest jackpot in Mega Millions history.

And yet, kicking off 2023 with $785 million could have a downside.

Get top local stories in DFW delivered to you every morning. >Sign up for NBC DFW's News Headlines newsletter.

"The curse of the lottery losers is very real," said Andrew Stoltmann, a Chicago-based lawyer who has represented several recent lottery winners.

One of the very first decisions a winner must make — whether to accept the jackpot as a lump sum or as an annuity — often ends up being their downfall, Stoltmann said.

More from Personal Finance:

4 key things to do if you actually win

5 tax and investment changes could boost your 2023 finances

Tips to help you build more emergency savings in the new year

Money Report

The jackpot for Tuesday night's drawing is now the fourth-largest lottery prize ever at an estimated $785 million, if you opt to take your windfall as an annuity spread over three decades. The upfront cash option — which most jackpot winners choose — for this drawing is $403.8 million, as of midday Tuesday.

These days, the annuity option is bigger than it previously was, relative to the cash option, thanks to higher interest rates, which make it possible for the game to fund larger annuitized prizes, according to the Multi-State Lottery Association.

Still, "over 90% of winners take the immediate lump sum," Stoltmann said. "That's typically a big mistake."

Not only does an annuity offer a bigger bang for your buck, but spreading out the payments also gives you a chance to build an experienced team, including an accountant, financial advisor and an attorney to protect the money and your best interests, according to Stoltmann.

"Few lottery winners have the infrastructure in place to manage a lottery windfall," he said.

That ensures a level of financial security that the lump sum does not, even with the inevitable onslaught of solicitations, excessive purchases or bad investments.

"To make a mistake with the first year's winnings is not catastrophic if the winner is going to receive another 29 years' worth of payments," Stoltmann said.

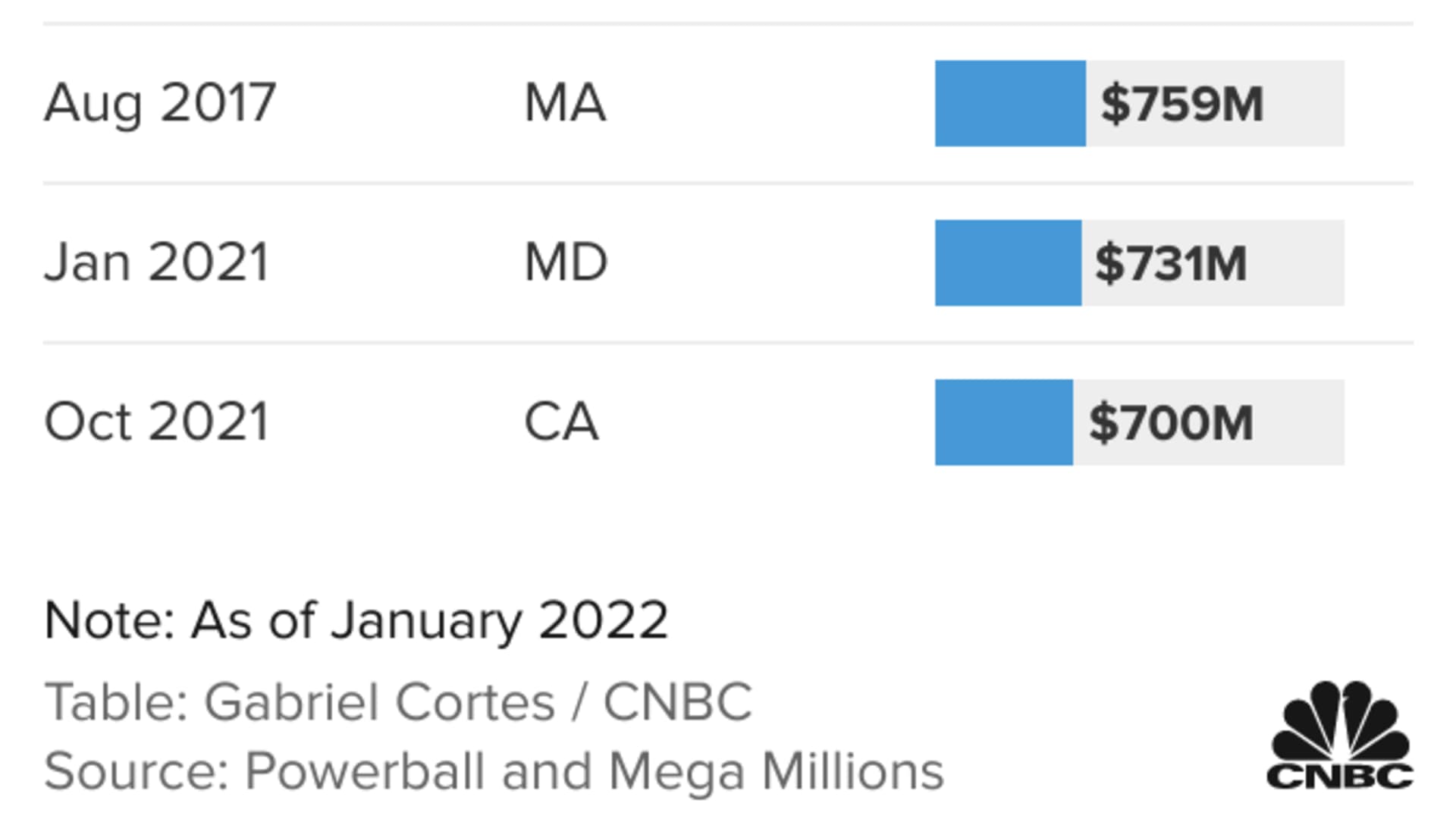

A breakdown of annuity payments vs. lump-sum payouts

Spreading out the payments is a worthwhile consideration, "especially in light of the math and psychology," said Joe Buhrmann, a certified financial planner and senior financial planning consultant at Fidelity's eMoney Advisor.

"Even if you spend it all, there's another check that comes next year," he said. "There's a great deal of certainty in that."

Then there are the tax consequences: Choose the cash option and a 24% federal tax withholding gets taken off the top — that's roughly $96.9 million — with another hefty bill likely due at tax time.

"The only deduction you have is the cost of your ticket," Buhrmann said.

Of course, you'll pay tax on the annuity checks, as well, but perhaps not as much on the investment income if the government is doing the work for you (essentially by putting the winnings in a portfolio of bonds rather than how you would have invested it).

Although you could likely make more by investing in the market over the same time horizon, there is far less risk since the annuity payments are guaranteed. Even if you die, future payments become part of your estate, just like any other asset.

"Don't get caught up in the nickels and dimes," said Susan Bradley, a CFP and founder of the Sudden Money Institute in Palm Beach Gardens, Florida.

Either way, "the payouts are huge and you will never be the same," she said.