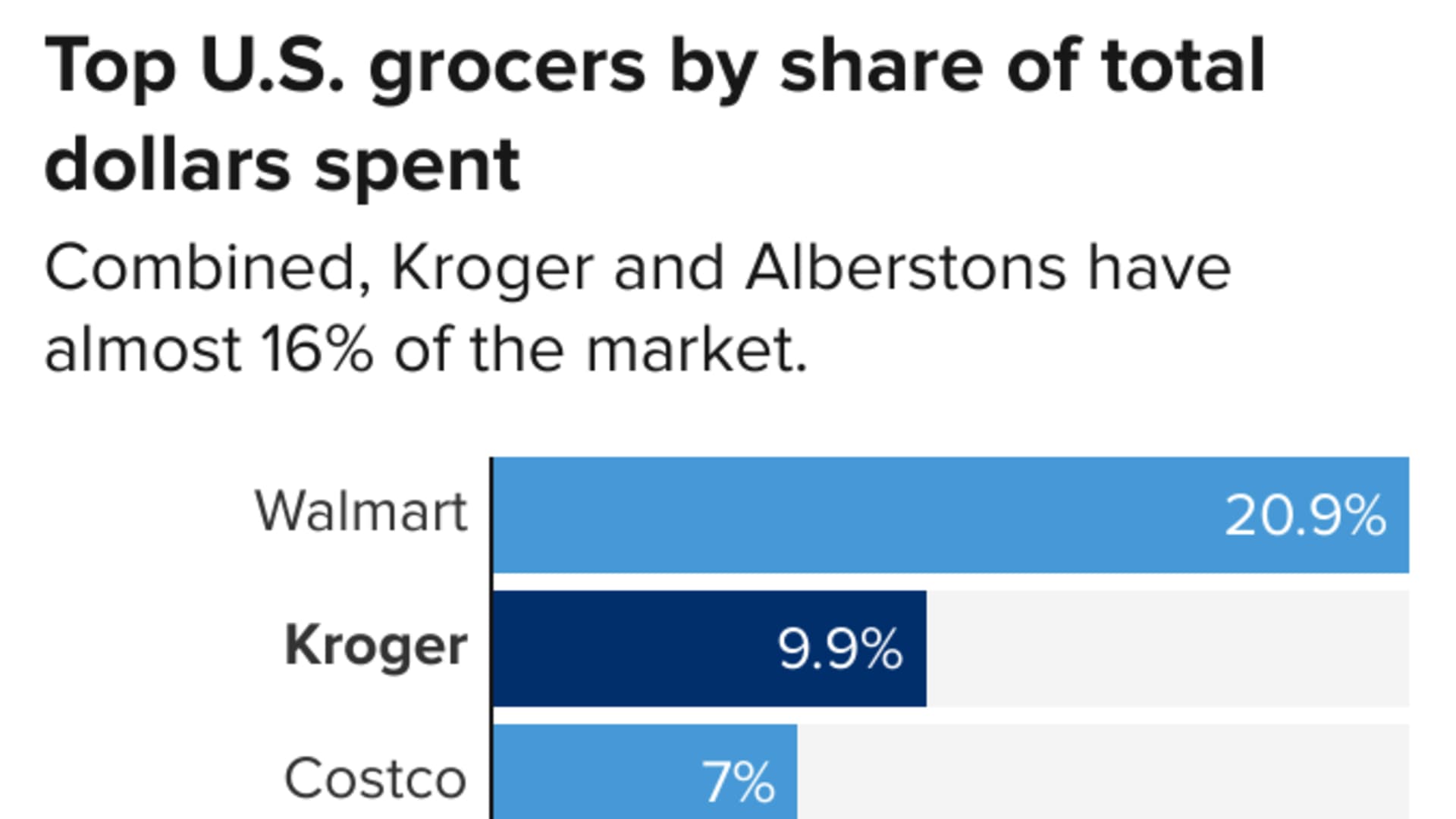

- Kroger is the second-largest grocer by market share in the United States, behind Walmart, and Albertsons is fourth, after Costco.

- The companies said Kroger agreed to buy Albertsons for $34.10 a share in a deal valued at $24.6 billion.

- Combined, Kroger and Albertsons employ more than 700,000 people across about 5,000 stores.

Rival grocers Kroger and Albertsons on Friday announced plans to team up.

The companies said Kroger agreed to buy Albertsons for $34.10 a share in a deal valued at $24.6 billion. Albertsons shares had closed Thursday at $28.63 after surging on reports that a deal was imminent.

Get top local stories in DFW delivered to you every morning. Sign up for NBC DFW's News Headlines newsletter.

Kroger is the second-largest grocer by market share in the United States, behind Walmart, and Albertsons is fourth, after Costco. Together, Kroger and Albertsons would be a closer second to Walmart.

Both companies' boards unanimously approved the agreement, which will also need regulatory approval.

Read more: How Kroger and Albertsons plan to win over Wall Street and Washington

Money Report

The tie-up comes during a challenging time in the grocery industry. Supermarkets have raced to keep up as shoppers embrace new ways of restocking the fridge. Companies have had to invest in automation, employee training and more as consumers bounce between browsing store aisles, ordering home deliveries and using curbside pickup.

Grocers have also been hit hard by inflation. Food prices have jumped 11.2% from a year ago, according to the most recent Bureau of Labor Statistics data. Companies have had to weigh when to pass on higher costs to customers and when to absorb them to stay competitive.

Kroger and Albertsons by the numbers

KROGER

- 2,800 stores in 35 states

- 420,000 employees

- 25 banners, including Fred Meyer, Ralphs, King Soopers and namesake stores

- $33.3 billion market capitalization

ALBERTSONS

- 2,200 stores in 34 states and Washington, D.C.

- 290,000 employees

- 22 banners, including Safeway, Acme, Tom Thumb and namesake stores

- $15.2 billion market capitalization

Source: Company websites, FactSet

The grocery industry is highly fragmented. Privately held regional grocers, such as H-E-B in Texas and Publix in Florida, remain power players and command strong loyalty. Relative newcomers such as discounters Aldi and Lidl, and Amazon's Amazon Fresh, have attracted customers, too. Plus, some Americans stock up on food at warehouse clubs such as Costco, Walmart-owned Sam's Club and B.J.'s Wholesale.

Kroger and Albertsons also each have numerous store banners, including names that the operators have acquired over the years. Kroger's banners include Fred Meyer, Ralphs and King Soopers, and Albertsons' banners include Safeway, Acme and Tom Thumb.

Combined, Kroger and Albertsons employ more than 700,000 people across about 5,000 stores.

Kroger captured about 9.9% of the U.S. grocery market in the 12 months ended June 30, according to market researcher Numerator. Albertsons' share was 5.7%. The next three big players after Albertsons are Ahold-Delhaize, Publix, Sam's Club and Target. Ahold Delhaize's banners include Food Lion and Stop & Shop, along with Fresh Direct, an online grocer that it acquired.

To team up, Kroger and Albertsons would need regulators to sign off. Regulators would look at where the companies have dominance and weigh if they would have too much power if combined, said Eleanor Fox, a New York University professor who specializes in antitrust and competition policy. A merger would be less likely to get approved if they are the top two grocers in many markets, she said.

Some of the companies' markets have significant overlap, such as Southern California, Colorado, Seattle and parts of the Midwest and Texas, Simeon Gutman, a retail analyst for Morgan Stanley, wrote in a research note Thursday. Other regions, such as the Northeast and Southeast, have very little overlap.

"Albertsons Cos. brings a complementary footprint and operates in several parts of the country with very few or no Kroger stores," Kroger CEO Rodney McMullen said in a news release announcing the deal.

The combination will likely undergo a lengthy review period by regulators and may require store divestitures, Morgan Stanley's Gutman said.

Gutman also cautioned on the financial upside of the deal. Consolidation in the grocery industry has not historically paid off in the form of higher profits, he said. However, he said the industry could be at a tipping point where a big merger could also lift margins.