By January 2021, Jasmine Taylor knew she needed to adjust her mindset around money.

The now 31-year-old from Amarillo, Texas, had barely made it through the holiday shopping season the month before. "I just remember wondering how I was going to make it through the next month," she tells CNBC Make It.

Taylor had recently lost her full-time job and was getting by on side hustles, delivering prescriptions for pharmacies and food for DoorDash. She held about $60,000 in student debt and another $9,000 in medical and credit card debt.

So, like just about everyone else looking to finally figure something out, she went to YouTube, where she discovered "cash stuffing," a money management strategy that changed her life. "I found cash budgeting and I literally stuck to it," Taylor says. "I would only spend what I had in cash."

Get top local stories in DFW delivered to you every morning. Sign up for NBC DFW's News Headlines newsletter.

She decided to hold herself accountable by posting on TikTok, which at the time was "mostly kids dancing," Taylor remembers.

Posts of her managing her finances by stuffing cash into envelopes soon went viral.

In the first year of getting her money in order, Taylor was able to pay off $23,000 in student loan debt and wipe out her medical debt and credit card balance. Once she established a big following (she currently has 628,000 followers in TikTok), she turned cash stuffing into a business — Baddies and Budgets — through which she sells money courses, budgeting supplies and other accessories.

Money Report

In 2022, the business pulled in about $850,000. This year, it's on track to clear $1 million.

Old-school budgeting: 'My grandmother used to do that!'

When Taylor began cash stuffing, she operated on a zero-based budget, which is the most common option among cash stuffers, she says. "That means you start your budget with whatever your paycheck number is, and you give every dollar a place to go, down to zero."

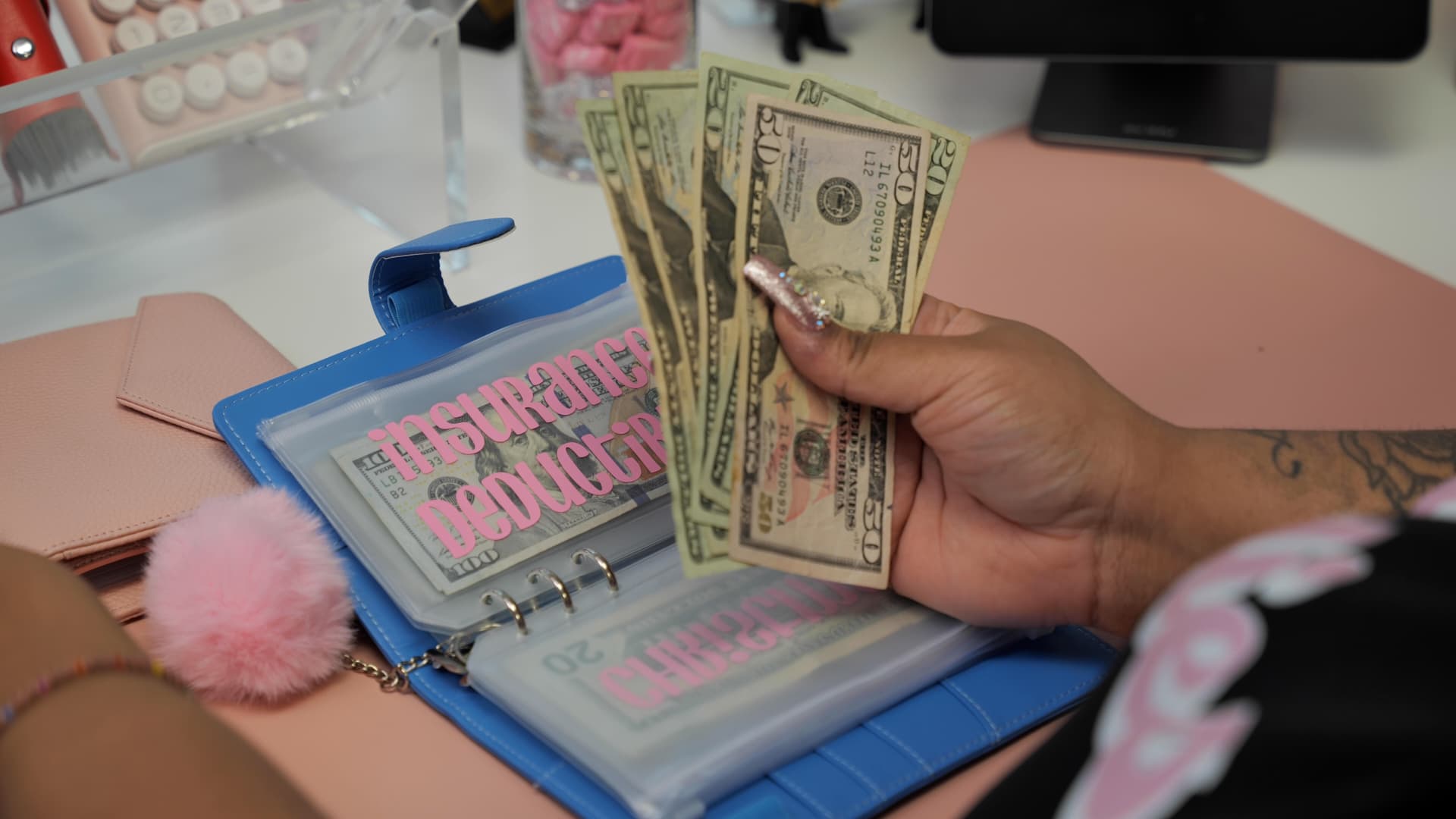

Once she has a plan in place for the month, she divvies up her money in the form of physical cash. "I put aside money for bills in envelopes. I put money aside for variable expenses, which is weekly spending," she says. "Then you also put money aside for 'sinking funds,' which are like little short-term or long-term savings accounts." Those can include an emergency fund, money for car maintenance or money earmarked for the holidays.

What's left over goes toward the future, either paying down debt or building up long-term savings. Taylor and her followers "stuff" the appropriate proportion of cash inside individual envelopes, or in labeled binders or cash wallets.

If this sounds familiar, it's because it is. The "envelope method" for budgeting has been around for decades, and was a popular way of managing household finances in the days before debit cards and online payments.

"I've had older women reach out. They come across my content, and they're like, 'My grandmother used to do that!'" Taylor says.

It didn't take long for Taylor to revamp her money habits. A few months in, after diligently tracking where all her money was going, she had saved $1,000. It was the first time in her life she had access to that much cash.

"I looked into the envelope, and it had been sitting there for awhile, and I'm like, 'Oh my god, I haven't needed this,'" she says. "It's a really surreal feeling when you're a person who has mismanaged money all their life, when you finally get to the point where it's like, 'OK, I can do this.'"

Turning a TikTok presence into a full-time business

After Taylor's early videos went viral, she wanted to capitalize on the large audience she had built. Looking around the marketplace, she noticed two things. First, in the realm of money content, which Taylor says she typically finds boring, she had found something that people genuinely wanted to engage with.

Second, she realized there was a market for people like her who found cash stuffing attractive but found plain, old envelopes drab. "I looked around, and I couldn't find a bunch of shops that were selling the items you needed to cash stuff," she says.

In spring of 2021, Taylor used her $1,200 stimulus check to form Baddies and Budgets, buying a Shopify account, shipping supplies, material for cash-stuffing wallets and a Cricut machine to print labels for envelopes and wallet covers.

Taylor, who had tried and failed at a few entrepreneurial ventures in the past — experiences she says she learned from — kept her expectations modest. "I just went into it hoping I would make my money back," she says.

She did, and then some: From April through year-end 2021, the business pulled in almost $250,000.

It's been rapid growth from there. Her line of products has expanded beyond just the necessities as more and more fans have begun to identify with her brand.

"A lot of people that buy from us are budgeters and people who save, but there are also people who buy from us because our stuff is really cute," she says. "They're the ones who wanted cups and keychains."

Even with the business on track to pull in more than $1 million this year, Taylor pays herself a salary of just $1,200 a week and reinvests heavily in the business. She still sorts out her finances in cash each week, setting aside some for her expenses and some toward retirement accounts and other savings challenges.

"The same stuff I teach my audience, I still use in my everyday life," she says.

DON'T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter

Take this survey and tell us how you want to take your money and career to the next level.