All Swatisha Keith wanted was a better life with better credit to help buy things she needed for her family.

The way to do that, Swatisha thought at the time, was only a computer click away – opening a trove of online sales pitches for CPNs, most commonly known as credit “profile” or “privacy” numbers, that, some websites promised, would increase her buying power.

Some ads suggest a CPN is a magic solution, a way to boost your credit score, so you can get that new credit card, a new car or a new house.

“You can use your CPN to build a brand new life,” said one ad on YouTube.

Other ads online make it sound like everyone is using CPN’s as a way to protect the privacy of their Social Security number.

In one YouTube video, a scholarly looking man smiling at the camera said: “CPNs are commonly used by celebrities, members of Congress and witnesses protected by the federal government.”

Swatisha connected with a CPN seller she found in an ad on Craiglist.

“I heard everybody was doing it … so I was like, ‘OK, we’ll do this,’ she said in an interview with NBC 5 Investigates.

NBC 5 Investigates

Uncover. Reveal. Expose.

She paid $1,500 for a nine-digit CPN, the same number of digits as in a Social Security number.

Swatisha said the seller told her she could use a CPN instead of her SSN to apply for credit, and that it would give her a new credit history and a chance to wipe her old history clean, she expected the reward to be a “brand-new beginning.”

At first, it seemed to work. She used her CPN to get a new credit card and a loan for a new car.

“Within two months of me having it, I saw my credit score go up. It was in the 700s. So I was like, 'This is perfect,'” Swatisha said.

But the dream ended when federal agents showed up at her work.

“I got taken downtown to the federal building where I was booked and held,” she said.

The mother of three was facing up to 30 years in federal prison.

“I was terrified because I didn’t think anything like that would ever happen to me because … I’ve never been in trouble with the law,” Swatisha said.

Matt Pannell, former special agent for the Social Security Administration, is well aware of cases like the one Swatisha got caught up in.

“They hear an idea that is seemingly too good to be true, and they choose to believe it,” Pannell said in an interview with NBC 5 Investigates.

Pannell, who as a federal agent investigated CPN cases in Texas and Oklahoma, said a person applying for credit cannot use a CPN when asked, instead, to provide their Social Security number on a credit application.

To do so “is a false representation on a loan application. And that’s against the law in this country,” he said.

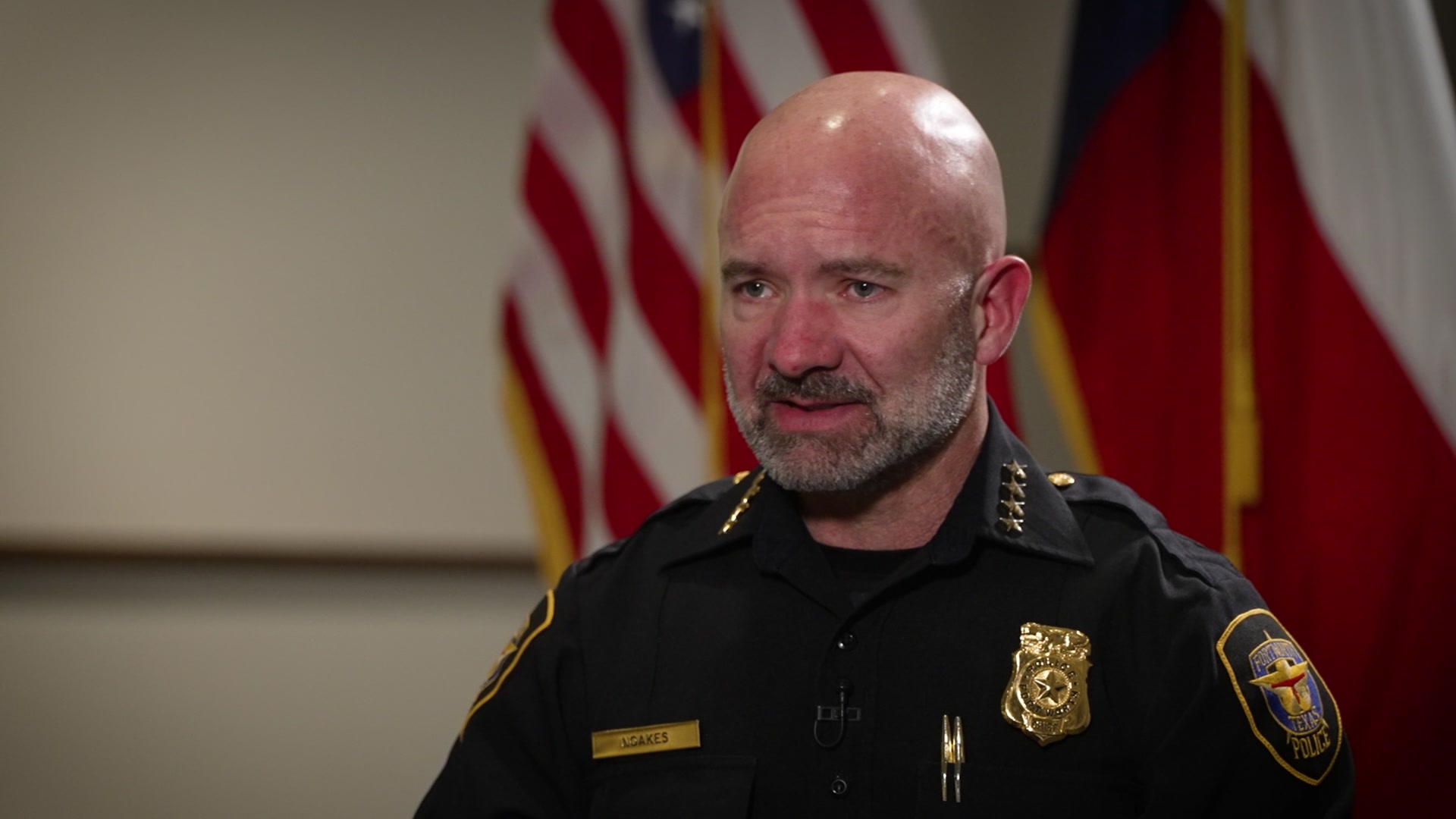

Yet such a crime is on the rise, especially in using a CPN to get a car loan, said Sgt. Darren Schlosser, with the fraud unit of the Houston Police Department.

Schlosser said some of the people he’s arrested seemed completely unaware they had committed a crime because they had read something that made them think it was OK to use a CPN.

“I’m extremely concerned that a normally law-abiding citizen would obtain a CPN because they’re desperate for a credit line they need,” the sergeant said.

Authorities told NBC 5 Investigates that many of the CPNs they see are really Social Security numbers belonging to children with no credit history.

Or, they said, CPN sellers may use certain websites to identify numbers that have not been issued yet as Social Security numbers.

Since banks and credit card companies sometimes run quick computer checks, they may not notice the number a person used on an application is not, in fact, the Social Security number they have used in the past.

“Without a doubt, more and more people are going to be brought into this world because of the sales pitches,” said Schlosser.

NBC 5 Investigates wondered who’s selling CPNs online in Texas, and what they’re saying to customers.

Our search led us to a meeting room at a Holiday Inn.

“I’ve been dealing with CPNs since I was, I think, about 18 years old,” said a man, going by the name “Tre the Credit Coach.”

We first saw him on his YouTube channel, where he said, “In one month total … we have done over 500 CPNs. Man, that is a lot.”

“When the 'credit coach' advertised a seminar at a Houston hotel, we sent an NBC 5 Investigates team member, with a hidden camera, to listen as he described himself as a CPN pioneer.

“I got in the CPN game before it was introduced to the internet. You know, I like to say that I’m one of the founders,” he said.

But he warned the group that if they wanted a CPN they might be too late, because banks were catching on.

“They scan every social that comes through there, and they’re going to shut down every CPN,” he said.

His real name, NBC 5 Investigates discovered, is Tremaine Manley.

Manley declined to go on camera but said in a telephone interview that he had only sold “maybe 10 (CPNs} over the past two years” – a far cry from the more than 500 he claimed to have sold online in a single month.

In the telephone interview, he said he warned customers that, “it’s on you to tell the bank that you are using a CPN,” and that if they are using one to apply for credit, they’re doing it “at their own risk.”

Manley said the CPNs he sells are not Social Security numbers belonging to other people.

Shortly after the telephone interview, he posted a message on YouTube saying, “We are not offering CPN numbers.”

Manley followed that with a video, telling viewers: “Some of you spent almost two years trying to figure this CPN thing out when you could have used that same amount of time figuring out your credit report.”

CPN sellers only break the law if they knowingly sell a stolen Social Security number or sell a fabricated credit history attached to a number.

But authorities said many sellers offer only nine-digit numbers – nothing more – shifting possible risks to customers.

“They are just the ones marketing this to people who are unknowing or unsuspecting that they are actually violating some federal law,” said Pannell, the former federal agent.

It was a lesson learned for Swatisha Keith, who avoided prison after federal prosecutors agreed to drop the charges once she served an 18-month probation and paid restitution.

“I wouldn’t want to see anybody else going through what I had to go through,” she said.

Swatisha now warns other people to never use anything but their Social Security number on a credit application.

“If I was them, I wouldn’t dare try it because, trust me, it’s going to come to an end,” she said.

NBC 5 Investigates found numerous websites selling CPNs, including one for a company that said it was based in Dallas. After attempting to contact someone with the company, it took down many of their postings, and the owner did not return our phone calls.

Meanwhile, this summer, the federal government will give banks additional tools, making it easier to check the number someone uses on a credit application to make sure it’s their Social Security number.

Those additional tools, investigators said, may mean more people could find themselves in trouble if they don’t know the rules.

Credit Tips

The information below can help you improve your credit score, recover from credit scams or simply see what your credit score is.

- Federal Trade Commission - The FTC enforces the Fair Credit Reporting Act, requiring the nationwide credit reporting companies – Equifax, Experian and TransUnion – to provide you with a free copy of your credit report, at your request, once every 12 months.

- AnnualCreditReport.com - The central website used by the three companies to provide the free reports.

- Better Business Bureau - The BBB gives tips on how to repair your credit and get out of debt.

- Better Business Bureau - Tips on how to avoid credit repair and debt relief scams.

- Consumer Credit Counseling Service - CCCS is a nonprofit organization that will help you find financial solutions to your financial problems.

- Transformance USA - Transformance promotes home ownership by providing financial education and debt management.

- Credit Karma - Credit Karma helps you file your taxes, provides credit scores, alerts you to important changes in your financial history and gives insight into credit well being.

- Intuit Turbo - Intuit Turbo combines your tax and credit information together to draw an overall picture of your financial health.

- Intuit Mint - Intuit Mint brings together all of your financial accounts, bills and more so you clan manage your finances from one dashboard.